New Model for Licensure, New CPA Exam Expected to Launch 2024

The CPA Evolution initiative is transforming the CPA licensure model to recognize the rapidly changing skills and competencies the practice of accounting requires today and will require in the future. It is a joint effort of the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA).

CPA Evolution

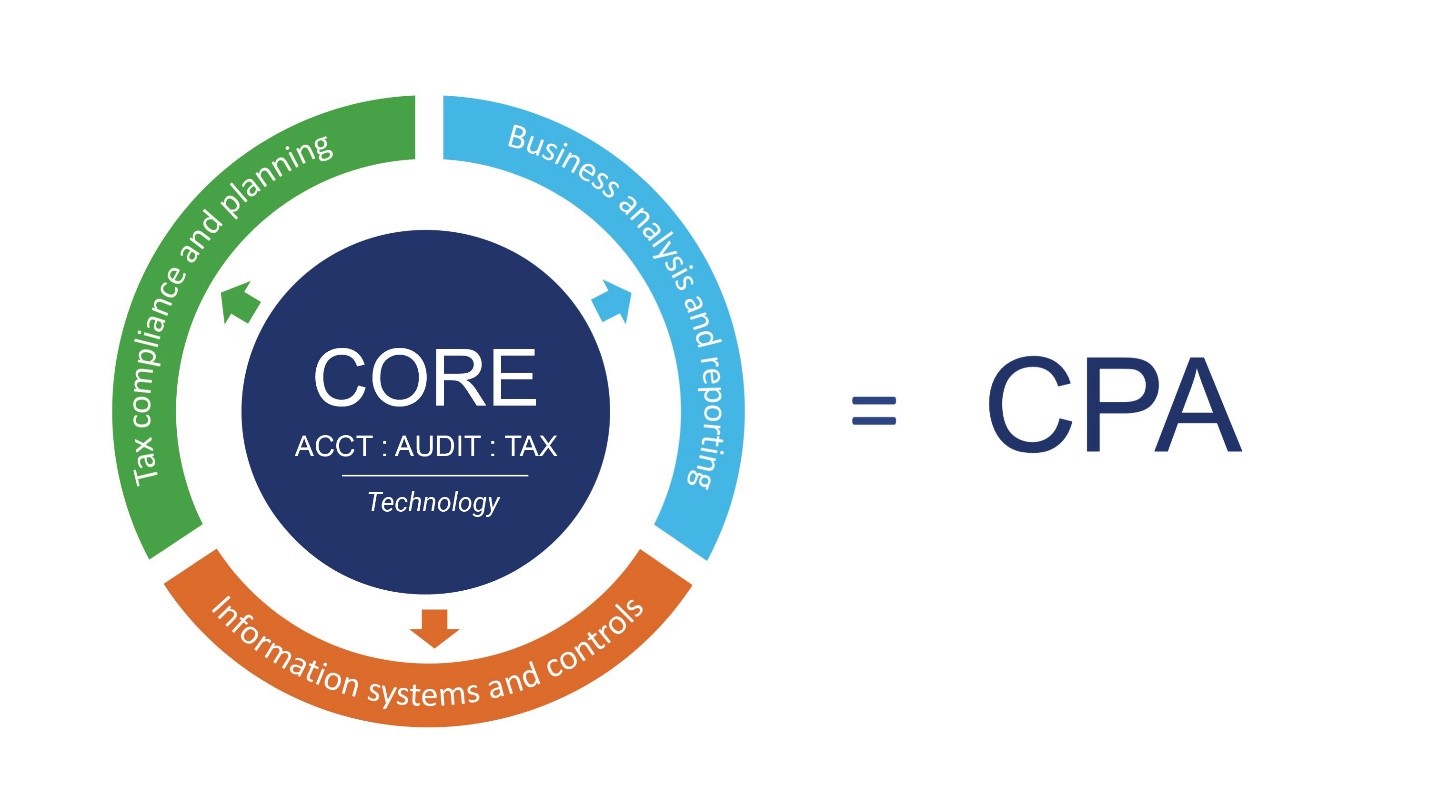

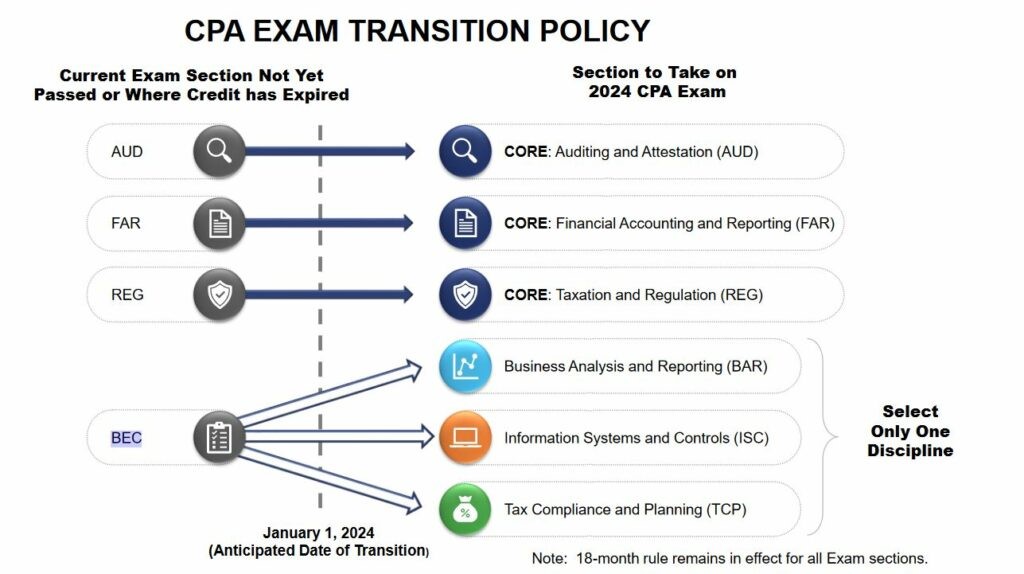

The CPA Evolution Licensure Model (CPA Evolution) establishes a foundation for the most important and relevant topics that new CPAs need to know to protect the public interest while providing an opportunity for candidates to choose one of three Disciplines as described below.

Under CPA Evolution, all candidates will be required to pass three Core Exam sections:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Taxation and Regulation (REG)

Each candidate will also choose one Discipline section to demonstrate knowledge and skills in that particular domain:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

Regardless of a candidate's chosen Discipline, CPA Evolution leads to CPA licensure, with rights, privileges, and responsibilities consistent with the present CPA license. CPA professional practice is not limited by the Discipline passed; professional standards provide guidance related to required competence and due care when performing professional services.

New Core + Discipline CPA Licensure Model

![]()

![]()

![]()

![]()

Kentucky Board of Accountancy's Extension of CPA Examination Credits

The Kentucky Board of Accountancy approved the following credit extension policy to aid in the transition to the new CPA Examination beginning January 1, 2024:

Any candidate with Uniform CPA Examination credit(s) on January 1, 2024 will have such credits(s) extended to June 30, 2025.

In addition, during its meeting on June 15, 2023, the Kentucky Board of Accountancy voted to adopt the NASBA Board of Directors' amendment to UAA Model 5-7, and subsequent implementation recommendation from NASBA's CBT Administration Committee, to increase, from 18 to 30 months, the time in which an exam candidate earning an initial exam credit must successfully complete remaining sections of the Uniform CPA Examination. The Board's administrative regulation effectuating this change became effective June 4, 2024, and it is now in place.

CPA Evolution Transition Period - Records updated (2/5/24)

NASBA has updated candidates' records to extend those with credit on January 1, 2024 to June 30, 2025. This was completed on Friday, February 2, 2024.

Any exam candidates with questions about the extension of existing credits, the adoption of the model UAA rules, or the credit relief initiative may contact NASBA atcri@nasba.org.

![]()

![]()

CPA Exam Transition FAQs

Below, are frequently asked questions to help you better prepare for the changes coming to 2024 CPA Exam through CPA Evolution. If you have additional questions that are not outlined below please reach out to us at cpa@ky.gov.

CPA Exam Transition FAQs

2025 Fee Change Implementation

The new schedule of testing fees, beginning January 1, 2025, for AUD, FAR, REG, BAR, ISC and TCP will be as follows:

AICPA $135.00 per section

NASBA $ 30.00 per section

Prometric $ 22.72 per test hour, plus

$ 6.76 per section security fee (or $97.64 for per section based on standard seat time of four hours)

Based on the above, the candidate cost per section (AUD, FAR, REG, BAR, ISC, TCP) will be $262.64 in 2025.